These factsheets provide information about the areas that will help GCIC clients to be abreast with relevant and up-to-date intelligence on the sector in order to optimize and effectively play their respective roles and make the desired impacts. This fact sheet provides some information on market trends, value chain dynamics, challenges and opportunities, as well as policy interventions, and some notable interventions for the Solar Energy industry within the Ghanaian context.

Solar Energy Applications and Climate Benefits

Several applications of Solar Energy exist. Solar photo-voltaic panels (solar-PV) turn light from the sun into electricity: solar lanterns, solar lighting kits, solar home systems, mini-grids, on-grid net metered solar, backup solar, on-grid large scale solar power generation and hybrid systems. Direct thermal uses the heat of the sunlight: solar water heating, solar drying, and solar cooking. Finally, Concentrated Solar Power (CSP) concentrates solar light onto a small area and generates electricity with the heat.

Several applications of Solar Energy exist. Solar photo-voltaic panels (solar-PV) turn light from the sun into electricity: solar lanterns, solar lighting kits, solar home systems, mini-grids, on-grid net metered solar, backup solar, on-grid large scale solar power generation and hybrid systems. Direct thermal uses the heat of the sunlight: solar water heating, solar drying, and solar cooking. Finally, Concentrated Solar Power (CSP) concentrates solar light onto a small area and generates electricity with the heat.

The above applications are climate friendly because they come with virtually no CO2 emissions; emissions occur only in the production process of the solar components.

Market Trend Analysis

Ghana is a high potential country for solar energy, as solar irradiation per square meter is very high in most of the country; up to 6 kWh/m2/day. Electricity penetration in Ghana (measured as number of the population with access) is estimated at about 78% (World Bank, 2016). This situation is owed partly to various strategies adopted to navigate various power generation and supply constraints by successive governments. The only issue with this statistics is that the percentage share of solar in the generation mix is less than one percent (Energy Commission, 2015). There is, therefore, a need of concerted efforts to increase this ratio. There are plans in place to shave off 200MW of power from the grid, through the National Rooftop Solar Energy Programme (NRSEP) expected to cover some 200,000 homes (Energy Commission, 2015). The overall target for renewable is to increase the capacity of renewable energy to 10% by 2020 (Renewable Energy in Ghana: Policy and Potential, 2015). The Sustainable Energy for All (SE4ALL) Action Plan of the Government of Ghana, launched in 2012, identifies off-grid solutions (solar home systems for smaller and dispersed communities, solar for ICT in schools in remote communities, solar for remote/river bank health facilities, solar lanterns for remote off-grid communities, and mini-grid renewable energy electrification for off-grid communities) to be strategic in achieving this target (Energy Commission, 2012).

Sector Value Chain, Projects & Programmes

The power supply industry in Ghana is regulated by the Energy Commission (EC), Public Utilities Regulatory Commission (PURC), the State Enterprises Commission (SEC), and the Environmental Protection Agency (EPA). The EC is responsible for technical regulation of the power sub- sector, including licensing of operators. In addition, EC also advises the Minister of Energy on matters relating to energy planning and policy. The PURC is an independent regulatory agency, and is responsible for economic regulation of the power sector, specifically approving rates for electricity sold by distribution utilities to the public; as well as monitoring of quality of electricity services delivered to consumers. Some major solar companies in Ghana include: DENG, Pumptech, 3SIL, Wilkins, PEG Ghana, Translight Solar, and Greenlight Planet among others.

The Ministry of Energy and Petroleum (MoEP), with its partners, is focused on the promotion of off-grid solar photo voltaic (PV) systems for more than two decades. It has focused primarily on lighting and other rural community household needs (distribution of solar home systems and solar lanterns). Under its auspices, the International Development Association (IDA), through the Association of Rural Banks (ARB) Apex Bank deployed a finance model for off-grid rural consumers. This helped install 15,000 systems for 90,000 rural people. Through this model, systems are paid for, using a 10% cash contribution from the beneficiary, a rural bank loan from the IDA fund and grant support from the Global Partnership on Output Based Aid (GPOBA) [International Renewable Energy Agency, 2015]. Installation, operation and maintenance is carried out by locally recognised companies. The most significant constraint to the successful implementation of the project was the absence of sufficiently trained solar installers. Luckily, the Energy Commission is offering subsidized training for solar technicians in 2018. Another intervention, an initiative of the World Bank, and financed by IDA and the Global Environment Facility (GEF) and other partners is the Ghana Energy Development and Access Project (GEDAP). This initiative has a focus to improve electricity access and distribution in Ghana. Solar PV systems were provided to 170,000 remote rural households who have little prospect of getting grid supply in the near term (World Bank, 2015).

In March 2018, while addressing a plenary session during this year’s International Solar Alliance (ISA) Summit at New Delhi, India, President Akuffo Addo outlined the following energy programmes to be implemented in Ghana by 2030: 1. to increase utility-scale solar electricity from about 22.5 megawatts to 250 megawatts by 2030, 2. to install 200,000 solar systems for households and industry in urban and selected non-electrified rural communities, 3. to establish of 55 solar/hybrid mini-grid electrification systems with an average capacity of 100kW, 4. to deploy 2 million solar lanterns to replace kerosene lanterns in rural areas. (Myjoyonline, 2018).

Challenges Facing the Solar Energy Sector

Following are some constraints hindering the growth of the solar energy sector in Ghana.

Demand & Supply

- High concentration of solar PV system retailers in Accra and Kumasi, making products not easily accessible to smaller communities.

- On-grid systems require a battery (where energy needs to be stored to serve peak load household demand in the night), thereby increasing installation cost.

- Independent Power Producers (IPPs) have difficulty in signing power-purchase agreements (PPAs) with the Electricity Company of Ghana (ECG).

Policy, Regulation & Enabling Environment

- Obtaining the right licenses and permits can be cumbersome and expensive for businesses.

- Uncertainty about duties and VAT on solar products. Only exempted when importing complete solar system (components).

- Uncertainty about mini-grids policy, especially in the area of grid extension

Financing

- For most renewable energy technologies, start-up costs are high, and upfront. Investment costs are relatively high for the low-income rural households needing renewable energy technologies.

- High commercial interest rates and unstable local currency (Cedi) makes production cost high for service providers

- Interest rates for off takers makes solar unattractive and limits the market to only users who can afford the upfront costs of the system.

Opportunities for Solar Energy Industry Players

Demand & Supply

- High potential for solar systems in urban areas for cost reduction and power generation stability in urban areas if a financial solution to remove the upfront cost and establish monthly payment can be established.

- Potential for solar home systems in peri-urban areas around big cities, where the grid has not yet arrived

- Potential for solar lanterns and lighting kits in remote rural areas

- Improvements in efficient appliances (TVs, radios, light bulbs) reduces system size, potentially reducing installation cost

- Innovative DC-appliances reduce need for inverters, which in turn reduces cost of installation

- Knowledge transfer of business models from other countries (in Africa) bodes well for emerging sector players

- Prices of solar panels continue to go down, potentially resulting in reduction in installation cost

Policy, Regulation & Enabling Environment

- Relative clarity on feed-in-tariffs due to publishing of tariffs by the Public Utilities Regulatory Commission (PURC).

Financing

- Pay-as-you-go model, in connection with huge growth in mobile money usage in Ghana makes a good case for flexible and sustainable end-user financing

- Monthly payment for solar systems in urban areas will enable migration to distributed renewable energy.

Success Story: Black Star Energy – Off-grid Mini-grid Interventions

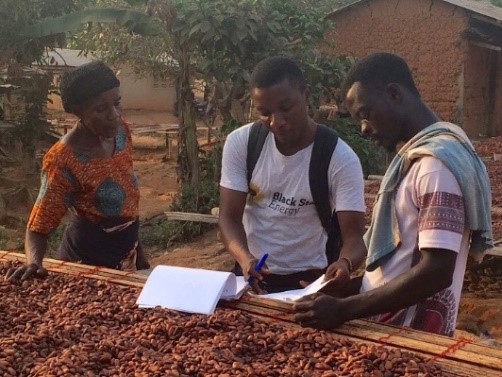

It is an undisputed fact that financing constraints remains a major setback for the solar energy sector. This affects businesses, as well as end users of the various products and services the businesses offer. Access to capital to support businesses, as well as robust financing schemes for end users is very critical. It is this regard that the work of Black Star Energy is commendable. The company employs a Pay-as-You Go (PAYG) financing model in providing off-grid solar-powered mini-grid solutions to about 1800 people in 6 rural communities in the Ashanti region of Ghana. End users sign up by making an initial deposit; and then make top-ups using scratch cards (sold from GHC1.00 and above) while using the system. An advantage of Black Star Energy’s mini-grids, over the use of stand-alone solar home systems is that these mini-grids can also provide power for productive use.

End-user Testing System Installation

End-users Signing Up to PAYG Scheme

The Ghana Climate Innovation Centre (GCIC) is a pioneering business incubator whose objective is to support entrepreneurs and ventures involved in developing profitable and locally appropriate solutions to climate change mitigation and adaptation in Ghana. The Centre’s key focus is on building businesses operating within the areas of energy efficiency, domestic waste management, solar energy, water supply management and purification and climate-smart agriculture. GCIC is part of the World Bank Group’s infoDev Climate Technology Program. Supported by the governments of Denmark and the Netherlands, the Centre is managed by a consortium led by the Ashesi University College and including Ernst & Young, SNV Ghana, and the United Nations University Institute for Natural Resources in Africa.